All Categories

Featured

Table of Contents

Simply like any kind of other irreversible life plan, you'll pay a normal costs for a last cost policy for an agreed-upon fatality advantage at the end of your life. Each carrier has various rules and alternatives, yet it's relatively very easy to manage as your beneficiaries will have a clear understanding of exactly how to spend the cash.

You might not require this type of life insurance. If you have irreversible life insurance policy in location your last expenditures may already be covered. And, if you have a term life policy, you might have the ability to transform it to a permanent policy without a few of the extra actions of getting last expense protection.

Made to cover minimal insurance demands, this sort of insurance can be an inexpensive alternative for individuals who merely intend to cover funeral prices. Some policies may have limitations, so it is necessary to check out the small print to be certain the policy fits your demand. Yes, naturally. If you're seeking a long-term choice, global life (UL) insurance policy stays in place for your entire life, so long as you pay your costs.

Final Expense Insurance Market

This alternative to final cost protection supplies alternatives for extra family protection when you need it and a smaller protection quantity when you're older.

Last expenditures are the expenses your family pays for your funeral or cremation, and for other things you could want back then, like a celebration to celebrate your life. Although considering final costs can be hard, understanding what they set you back and ensuring you have a life insurance policy plan huge sufficient to cover them can help save your family an expenditure they may not have the ability to pay for.

Old Age Funeral Cover

One choice is Funeral service Preplanning Insurance coverage which allows you choose funeral services and products, and fund them with the acquisition of an insurance plan. One more option is Final Expenditure Insurance Coverage. This sort of insurance gives funds straight to your recipient to help spend for funeral and various other expenses. The quantity of your final expenses relies on a number of things, including where you stay in the United States and what type of final plans you want.

It is projected that in 2023, 34.5 percent of households will pick interment and a higher portion of households, 60.5 percent, will certainly choose cremation1. It's estimated that by 2045 81.4 percent of family members will certainly select cremation2. One reason cremation is becoming a lot more popular is that can be cheaper than burial.

Mutual Of Omaha Final Expense Insurance

Relying on what your or your household want, things like interment plots, severe markers or headstones, and caskets can increase the cost. There might additionally be expenditures in addition to the ones specifically for interment or cremation. They could consist of: Treatment the cost of travel for family and enjoyed ones so they can participate in a solution Provided meals and other expenditures for a celebration of your life after the solution Purchase of unique attire for the service Once you have a good idea what your last expenditures will certainly be, you can help plan for them with the right insurance coverage plan.

Medicare only covers medically needed expenses that are needed for the medical diagnosis and treatment of an ailment or problem. Funeral costs are ruled out clinically required and as a result aren't covered by Medicare. Final expense insurance coverage uses an easy and fairly affordable method to cover these expenditures, with policy advantages varying from $5,000 to $20,000 or more.

People normally buy last cost insurance with the intent that the recipient will certainly utilize it to pay for funeral prices, superior financial obligations, probate costs, or various other associated expenditures. Funeral prices might include the following: People commonly wonder if this type of insurance coverage is necessary if they have cost savings or other life insurance.

Life insurance policy can take weeks or months to payment, while funeral service costs can begin including up immediately. The beneficiary has the final say over how the money is utilized, these plans do make clear the insurance holder's intention that the funds be utilized for the funeral service and related prices. People often acquire long-term and term life insurance to help give funds for recurring expenditures after a person passes away.

Death And Burial Insurance

The finest way to make sure the policy amount paid is invested where intended is to call a beneficiary (and, sometimes, a secondary and tertiary beneficiary) or to put your wishes in an enduring will certainly and testament. It is typically a great practice to notify main recipients of their expected tasks as soon as a Final Expense Insurance coverage is gotten.

Costs begin at $22 per month * for a $5,000 insurance coverage policy (premiums will differ based on issue age, gender, and protection amount). No clinical evaluation and no wellness questions are needed, and consumers are ensured coverage through automatic certification.

For additional information on Living Advantages, click on this link. Protection under Surefire Concern Whole Life insurance coverage can usually be settled within two days of first application. Begin an application and buy a policy on our Guaranteed Problem Whole Life insurance policy DIY web page, or call 800-586-3022 to speak to a qualified life insurance agent today. Listed below you will locate some regularly asked concerns should you pick to look for Last Cost Life Insurance Coverage by yourself. Corebridge Direct accredited life insurance policy agents are waiting to answer any additional concerns you could have pertaining to the protection of your loved ones in the occasion of your death.

The child biker is bought with the notion that your youngster's funeral expenditures will be completely covered. Kid insurance motorcyclists have a death benefit that ranges from $5,000 to $25,000. When you're regreting this loss, the last point you require is your financial debt adding difficulties. To purchase this biker, your child has their very own criteria to fulfill.

Burial Insurance For Parents Over 80

Note that this plan only covers your kids not your grandchildren. Last expenditure insurance coverage policy benefits do not end when you sign up with a plan.

Cyclists include: Faster death benefitChild riderLong-term careTerm conversionWaiver of costs The accelerated fatality advantage is for those that are terminally ill. If you are critically unwell and, depending on your certain plan, identified to live no longer than six months to two years.

The Accelerated Survivor Benefit (in many instances) is not exhausted as income. The drawback is that it's going to decrease the survivor benefit for your recipients. Getting this additionally requires evidence that you will certainly not live previous six months to 2 years. The youngster motorcyclist is purchased with the notion that your kid's funeral costs will certainly be completely covered.

Insurance coverage can last up until the child transforms 25. Additionally, note that you might not be able to sign your kid up if she or he suffers from a pre-existing and dangerous problem. The lasting treatment rider is comparable in concept to the sped up survivor benefit. With this one, the idea behind it isn't based upon having a brief amount of time to live.

Senior Final Expense Life Insurance Plan

Somebody who has Alzheimer's and needs everyday help from health and wellness aides. This is a living advantage. It can be borrowed against, which is very valuable due to the fact that long-lasting care is a substantial expenditure to cover. A year of having a person take treatment of you in your home will certainly cost you $52,624.

The motivation behind this is that you can make the button without going through a clinical exam. And because you will no much longer be on the term policy, this likewise implies that you no more have to fret about outliving your plan and losing out on your death benefit.

The specific amount relies on different elements, such as: Older people generally face higher costs as a result of raised health dangers. Those with existing health problems may encounter greater premiums or constraints on protection. Higher protection amounts will normally lead to greater premiums. Remember, plans normally peak around $40,000.

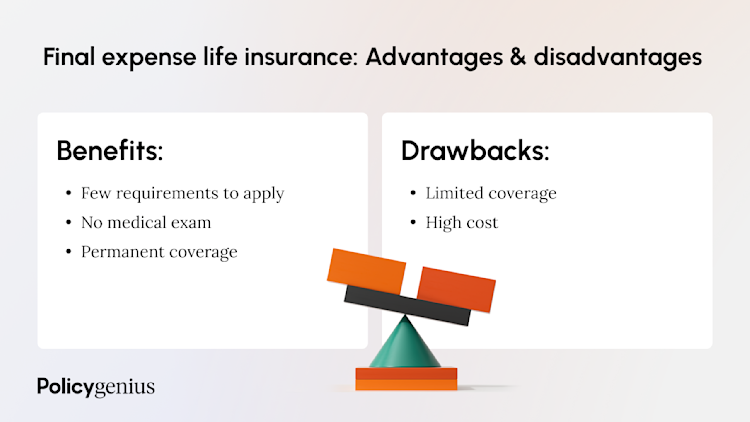

Consider the monthly premium repayments, however also the assurance and financial protection it provides your family. For lots of, the peace of mind that their loved ones will certainly not be burdened with economic challenge throughout a challenging time makes last expense insurance a rewarding financial investment. There are 2 kinds of final cost insurance:: This kind is best for people in fairly health that are trying to find a means to cover end-of-life expenses.

Protection amounts for simplified concern plans generally go up to $40,000.: This type is best for individuals whose age or health and wellness prevents them from purchasing various other sorts of life insurance policy coverage. There are no health and wellness needs at all with assured problem plans, so any person that meets the age demands can commonly certify.

Below are some of the factors you should take into consideration: Examine the application procedure for various policies. Make sure the carrier that you pick supplies the amount of insurance coverage that you're looking for.

Latest Posts

Burial Insurance Quotes For Seniors

Final Expense Companies

How To Sell Final Expense Insurance